Our Philosophy

Purposeful Investing. Enduring Conviction.

Chakra Growth Capital builds on RiSo Capital’s early-stage roots, evolving into a global growth platform backing software-led, AI-driven enterprises transforming industrial automation, energy, and mobility.

We invest in gritty founders applying breakthrough technologies—AI, electrification, digitization- to large, established markets. As our Managing Partner, Sri Purisai, notes: when transformative tech meets real market depth and a high-performing team, it creates outsized value and defensible category leadership. This is the risk reward profile we specialize in.

Our platform supports companies at pivotal inflection points: moving from founder-led to institutional operations, from custom builds to scalable systems. Each vehicle is designed for its stage, creating an adaptive architecture that evolves with markets and opportunities.

Our team has scaled businesses from $10M to $100M+, giving us a unique position between venture capital and private equity. We pair disciplined capital deployment with deep operational partnership—bringing networks, strategy, and hands on execution to accelerate scaling.

We back founders with grit, clarity, and the ability to execute in complex markets—partnering early and staying committed through multiple cycles of growth to build durable, compounding enterprises.

Our Focus

Brave Ideas. Visionary Founders.

At Chakra Growth Capital, we back founders at the pivotal moment between validation and velocity. We invest in early- to growth-stage companies that have achieved product-market fit and are ready to scale with capital, strategic clarity, and operational rigor.

We focus on technology-led, asset-light, enterprises operating in AI infrastructure, industrial automation, mobility, and energy systems, and data-centric software platforms – sectors where efficiency, intelligence, and operational leverage create compounding enterprise value.

Our geographic lens is global, with a strategic emphasis on India-linked innovation, serving large international markets.

We partner with Chakra-ready founders—leaders who combine clarity of thought, deep grit, and a bias towards disciplined execution. These are founders who welcome operational engagement, embrace, data-driven decision-making, built for profitability, as well as growth, and can execute in complex or rapidly evolving markets.

We typically pass on teams that depend on heavy capital cycles, lack a clear path to operational leverage or are not aligned with the rigor and partnership model that defines the Chakra platform.

Grit-driven, humble, resilient founders

Mobility, Energy, Buildings, and Industrial

Global mandate with a strategic focus on India

Market creators and industry reshapers

Asset-light software, data and “physical AI”

Automation & AI, Electrification, and Digitization

PMF-validated, scaling user traction

B2B or B2B2C models with high-value, recurring revenue

Strong fundamentals with compounding value

OUR POLICY

Intelligent Impact & ESG Framework.

At Chakra Growth Capital, we back companies building strong fundamentals with compounding value. That means sustainable unit economics, capital-efficient growth, excellent governance, and business models designed for long-term resilience—not quarterly optimization.

Many of our investments happen to be in sectors driving efficiency, automation, and transformation of legacy industries. We believe the biggest returns over the next decade will come from companies solving real problems—reducing waste, optimizing resources, and building infrastructure for a more efficient economy. We invest in these not as impact plays, but as superior businesses.

Our Portfolio

Breakthroughs Driving a Smarter Tomorrow.

Chakra Growth Capital backs AI-driven, software-led enterprises with strong fundamentals, sustainable unit economics, and compounding value—companies building the infrastructure for a more efficient economy.

Chakra – Built to Scale

|

Growth-Stage.

At Chakra Growth Capital, we partner with founders at a critical inflection point: leap from ad hoc operations to scalable, repeatable systems – built on strong fundamentals with compounding value.

Our core conviction: the biggest returns over the next decade will come from light-asset, intelligent and automated enterprises – businesses that leverage software and data to optimize operations, drive energy and resource efficiency, and enable electrification and industrial automation – without the capital intensity of traditional infrastructure.

RiSo – Rise & Soar

|

Early-Stage.

At RiSo Capital, we back founders at the earliest stages of innovation, helping them transform bold ideas into validated, scalable ventures.

Our focus is on India-first, global-next innovators building businesses at the intersection of AI data, and automation – companies with strong fundamentals, product-market fit, and ambition to scale across global markets.

Our Story

Redefining the Future, One Leap at a Time.

Chakra Growth Capital is a global alternative investment platform backing asset-light, technology-led, enterprises across energy, mobility, industrial automation, and AI-driven infrastructure. We invest where software, automation, and data intersect with large traditional sectors—unlocking efficiency, operational leverage, and long-term value.

Our roots began with RiSo Capital, where disciplined early-stage investing in India-first global-ready ventures built a strong foundation in AI, data, and automation. These early successes shaped our belief in close founder partnership and fundamentals-first value creation.

Chakra extends that foundation into growth-stage investing—partnering with founders at critical inflection points to move from ad hoc operations to scalable systems, and from early traction to global expansion. We focus on companies with strong fundamentals and compounding value models that can scale without heavy asset intensity.

Our Venture Equity structure brings together venture-style upside with private equity-level discipline. We invest in enterprises powering automation, energy transition, and digital infrastructure, applying strategic clarity and hands-on operational expertise to accelerate scaling.

Our evolution reflects a commitment to an expanding, adaptable platform—rooted in the values, discipline, and founder-first approach that define our journey. Supported by a global network of family offices and strategic partners, we provide companies with access to markets, customers, and expertise that materially shift their trajectory.

With a rigorous review process and a selection rate below 1%, only the most exceptional opportunities become part of our portfolio.

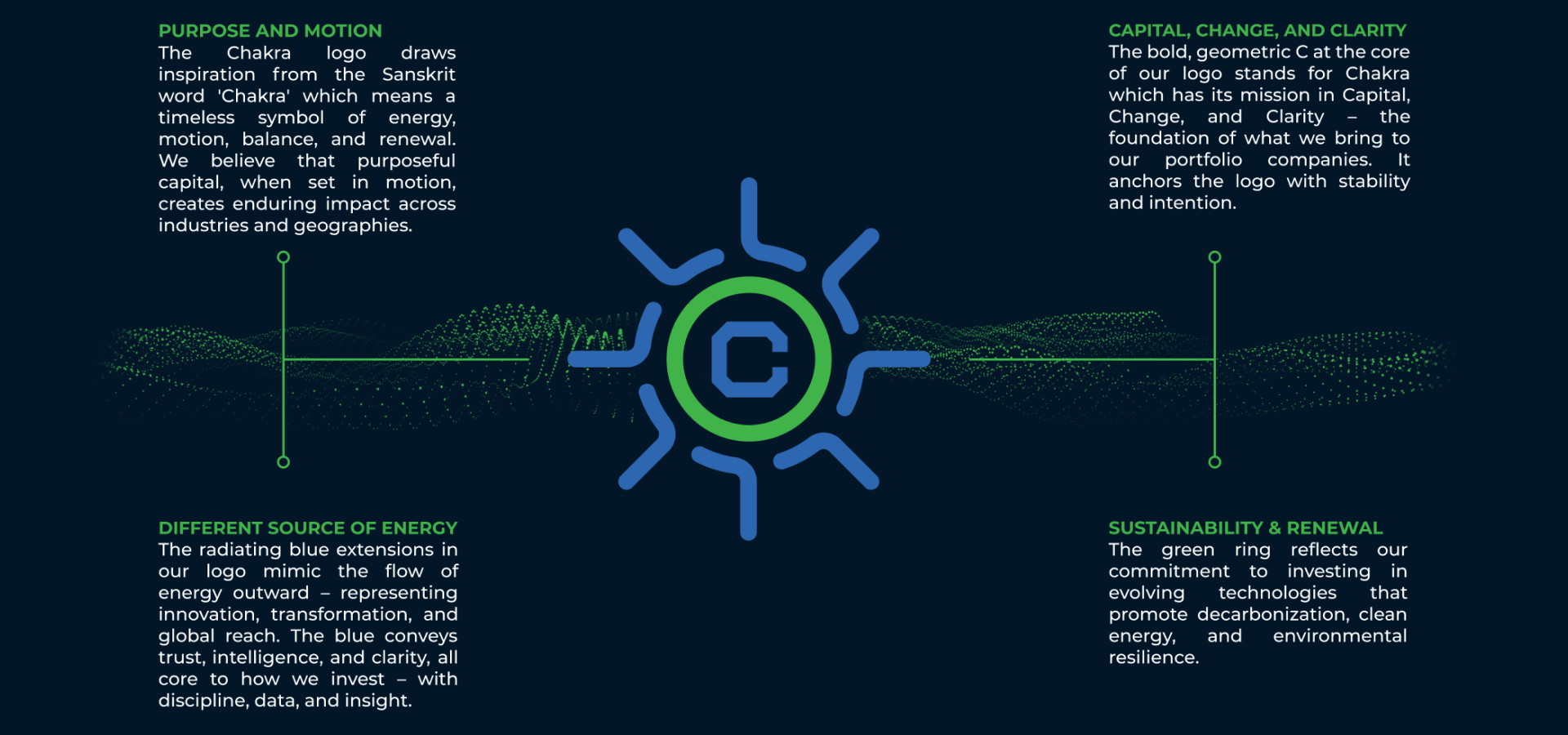

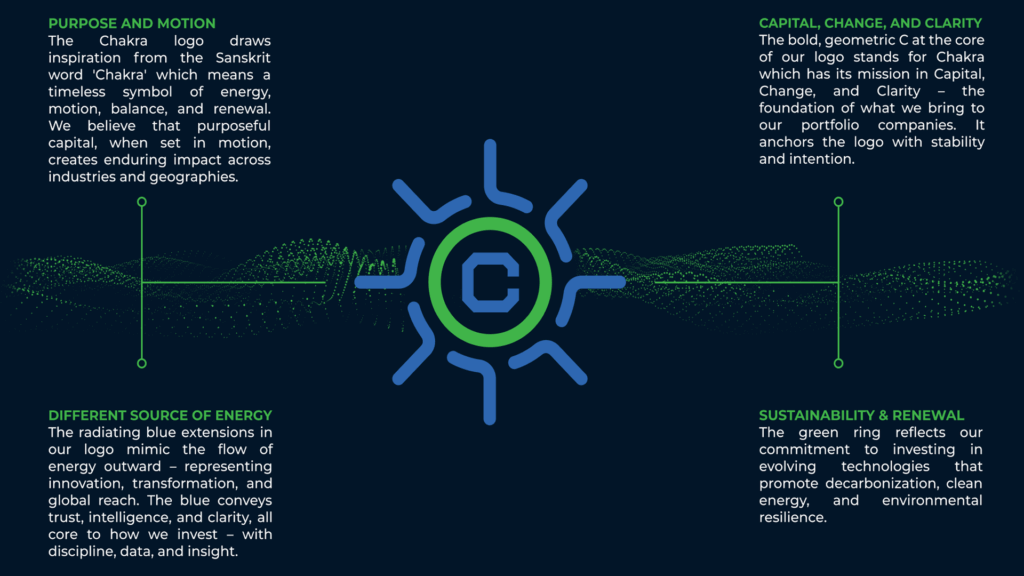

About Our Name: Chakra

Chakra in the ancient Sanskrit language signifies

⁃ Different levels of energy

⁃ Circular, signifying wheels and mobility/movement

⁃ Circular signifying recycle and renew allowing energy conservation

Our Team

Operators Turned Investors. Strategists Fueling Growth.

Our team has built businesses from $10M to $100M+, navigating the full spectrum from early-stage chaos to global operations. We have been in the founder’s seat, made the mistakes and learned what it takes to move from ad hoc systems to institutional-scale enterprises without losing speed or agility.

Today, we deploy that hands-on experience as growth investors, backing founders who have proven their model and are ready for the hard work of scaling. We invest in companies building the software, data, and automation layers, that enable electrification, industrial, efficiency, and resource optimization – asset-light businesses that scale rapidly without the capital intensity of traditional infrastructure.

We partner with founders to build repeatable sales motions, higher world-class functional leaders, expand into new markets, and navigate complex regulatory environments. We don’t just fund growth – we help create the systems, processes, and operational rigor that sustain it.

At Chakra, we invest in light-asset, intelligent, and automated enterprises – companies that combine strong fundamentals with compounding value, built to scale efficiently from ad hoc operations to repeatable, global systems.

Partners

Leading Global Growth with Vision and Precision.

The managing team at Chakra Growth Capital brings decades of global experience in leading large-scale operations and making strategic investments. With deep networks and cross-border expertise, the team actively supports portfolio companies to create long-term value and successful exits. By combining the ambition of venture investing with the discipline of operational excellence, Chakra follows a “balanced risk” approach—driving growth while managing downside risk.

Sri Purisai

Founder, Managing Director

Maya Gadhvi

Founding GP

Mark Joseph

Founding GP

Ramprasad Kandadai

Founding GP

Mahendra Jain

Founding GP

Advisors & Investment Team

Our investment team combines strategic foresight with in-depth market research to drive informed decisions.

With a strong focus on risk management and value creation, we aim to maximize returns.

We continuously monitor market trends to identify the best opportunities for sustainable growth.

Vineeta Gupta

Principal

Rahul Chopra

Manoj Kohli

Arjun Malhotra

Deepak Kamlani

Nihar Patel

Saiesh Reddy

Maha Achour

Will Foss

Ameet Konkar

Sudhakaran Ram

Naitik Udeshi

Contact

We’re here to help

Looking for investment opportunities or funding for your startup? Get in touch with our experts.